Quit Your Job And Live

A beginners guide to Building a

Location Free Income & Travel

Hacking Your Way Around the World

By Adrian Landsberg

Table of Contents:

Introduction

Chapter 1: Building A Location Free Income

Chapter 2: Saving Money And Living Better On Less

Chapter 3: Travel

Chapter 4: Living A Kick Ass Life

Chapter 5: Your Job

Chapter 6: Self Improvement

Chapter 7: Keeping Fit And Eating Right

Conclusion

Start Building Your Passive Income ~ Samuel F. Campbell

Table of Contents:

Introduction

Chapter 1: Building A Location Free Income

Chapter 2: Saving Money And Living Better On Less

Chapter 3: Travel

Chapter 4: Living A Kick Ass Life

Chapter 5: Your Job

Chapter 6: Self Improvement

Chapter 7: Keeping Fit And Eating Right

Conclusion

Start Building Your Passive Income ~ Samuel F. Campbell

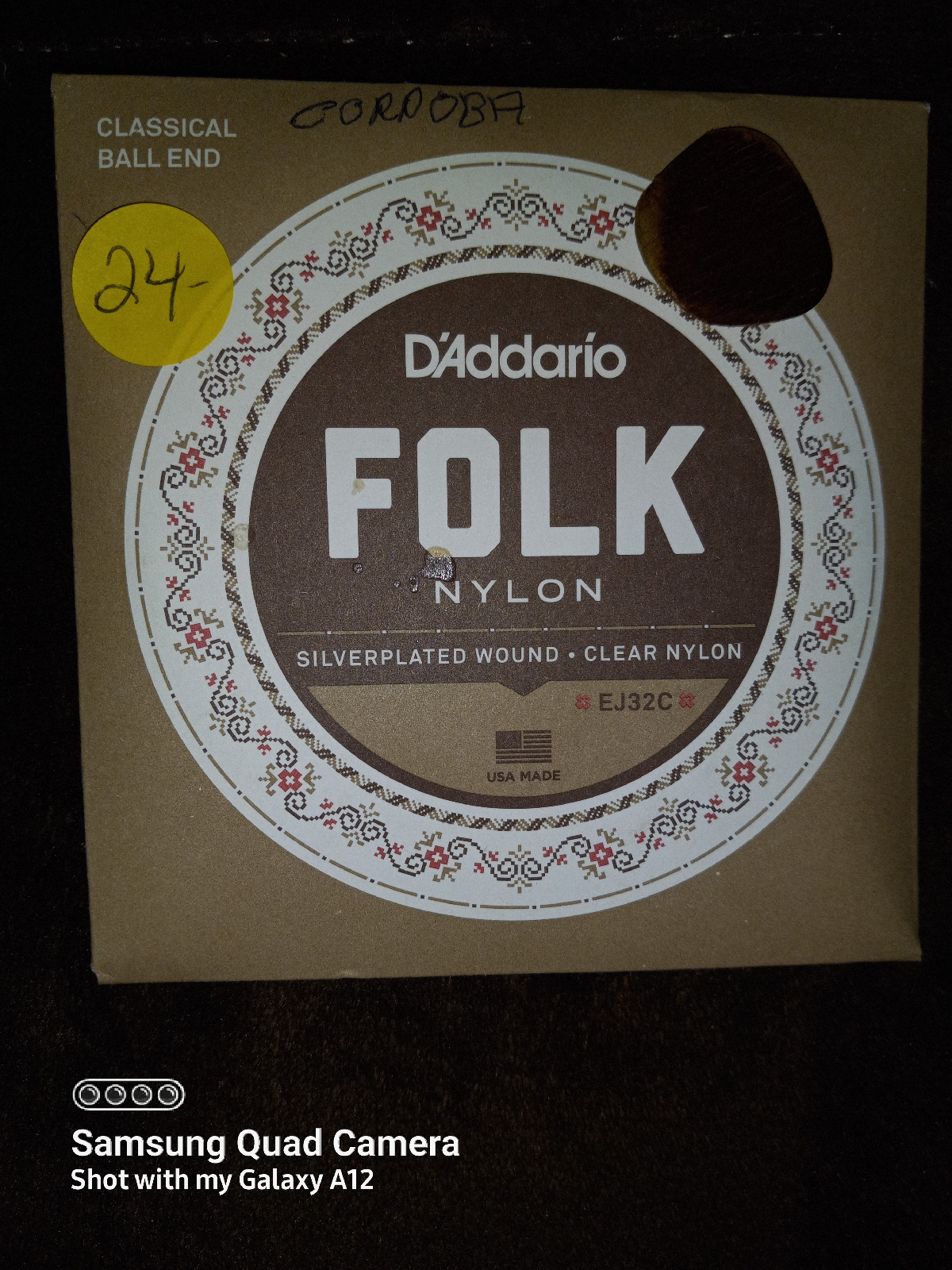

A Web site you can start for around $20.00 - It can take you a longtime to make money, it at all, and you will also have to put a lot of time into it as well.

Property - Obviously real estate is an expensive way to start building your passive income but it can also be the quickest. You will be spending tens or hundreds of thousands. With property you could buy it, have it settle in a month or so, put in a tenant and if you’ve been smart and bought well, you could have ‘X’ amount of weekly cash flow.

To get a loan at a bank - has their set of criteria you will have to meet to qualify for a loan but as long as you meet that then you can start looking.

Property Step 1 -

First you need to set a Passive Income Goal This doesn't have to be a total figure (what you need to survive), it just needs to be your first broken down part of your goal. things easier it's best to break things down into smaller more manageable goals.

We could start with $20.00 a week or $50.00 a week That's up to you, just make sure it’s just far enough out of reach but still a figure that is realistic enough for you to be motivated to reach it

And since we're talking about real estate here your target income will be dictated by how much seed money you have to invest anyway.

Property Step 2 -

How much money do you have? If you have ten thousand dollars in the bank that your willing to invest then there is a good chance you may be able to buy a property.

Obviously the bank has their set of criteria that you will have to qualify for a loan but as long as you meet that then you can start looking. You will just have to start off small, and that's fine because that's where you should be starting.

Budgeting out your costs is very important and make sure you know every cost. When buy9ing property your purchasing costs will be the deposit, solicitor fees, stamp duty , and mortgage insurance and three can be other smaller miscellaneous costs.

Step 3 -

You can buy a property for no more than $100k. They may not be near where you live or be anything to special, but the good thing is it will be a start. Keep your end goal in mind.

So start researching, get on your countries real-estate websites and punch in your criteria. Finding an area, a good area can be half the battle but since you have a budget of $100K that will at least narrow down your options.

Start by searching state by state, and see what towns pop up, if in the one town houses come up very cheap in one area and dearer in another you can find out which areas may be ones to steer clear of.

A good tip is to ring up a property manager in the area and say that you are looking at buying there and you were wondering what areas of town to steer clear of . While you’re talking to them ask about rents, are houses renting easy, what’s the vacancy rate, do units rent better than houses etc.

Depending on how much available money, time and patience you have, will depend on the type of properties you can short list. Do you want to renovate? Are you happy to have a property that’s in average condition so you can get it cheaper? Are you happy to accept a smaller rental return?

Investments are all about numbers, forget about how nice the curtains look or how nice the owner was, you are an investor and you’re doing this to make money. Work out these things:

It’s important to get these costs right, overestimating is a good idea. Add all your costs up. Check the rental prices in the area you are buying and get a fell for where your property would fit in. Have a worst case and best case scenario rent and deduct all your costs from this figure.

Dose it look good? Is there enough left over to meet your minimum profit margin? This may sound like a tedious process but after a while of looking at properties and going through these figures you will be able to tell within 10 seconds whether a house is any good to you.

Step 4 -

Put in an offer! Don’t be scared to put in a low ball offer, you can always come up in price, but you can’t come down. Prosperities that have been on the market for a while are a good target for low offers, as is a one that is in bad condition.

Sometimes the vendor will flat out reject your offer. That’s fine, you can let them wait.

Sometimes I've waited a week before I have counter offered, sometimes they may get back to you before then, just don't look like you're in a rush, you don't want to look too keen. This could go back and forward for a little while, but if it's a house you're very keen on, the numbers add up and you think that the property may be snapped up quickly I advise that you put in a good offer first!

Step 5 -

So your offer has been accepted! Awesome! This is where you start to get your solicitor involved, they will take care of most things for you. I have typically paid around the $1000AU

Sometimes I've waited a week before I have counter offered, sometimes they may get back to you before then, just don't look like you're in a rush, you don't want to look too keen. This could go back and forward for a little while, but if it's a house you're very keen on, the numbers add up and you think that the property may be snapped up quickly I advise that you put in a good offer first!

Step 5 -

So your offer has been accepted! Awesome! This is where you start to get your solicitor involved, they will take care of most things for you. I have typically paid around the $1000AU

https://youtu.be/MY5Iwq6A4gs

Fed Retire

No comments:

Post a Comment